General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsTen Sneaky Sleeper Provisions in Trump's Big Beautiful Bill

Gasp! Let's hope people read the fine print.

https://prospect.org/blogs-and-newsletters/tap/2025-05-23-ten-sneaky-sleeper-provisions-trumps-big-beautiful-bill/?fbclid=IwY2xjawKfArVleHRuA2FlbQIxMQBicmlkETFCc05WOThDMTA4ajhxSHBDAR6WPV7985qK8-sHJaiDOSK-8bYVNR3mv2CMa3celrc9Jn4d9bUqJZVRFStEJA_aem_yyMbR5rD3IFxCw_Rsv4tFA

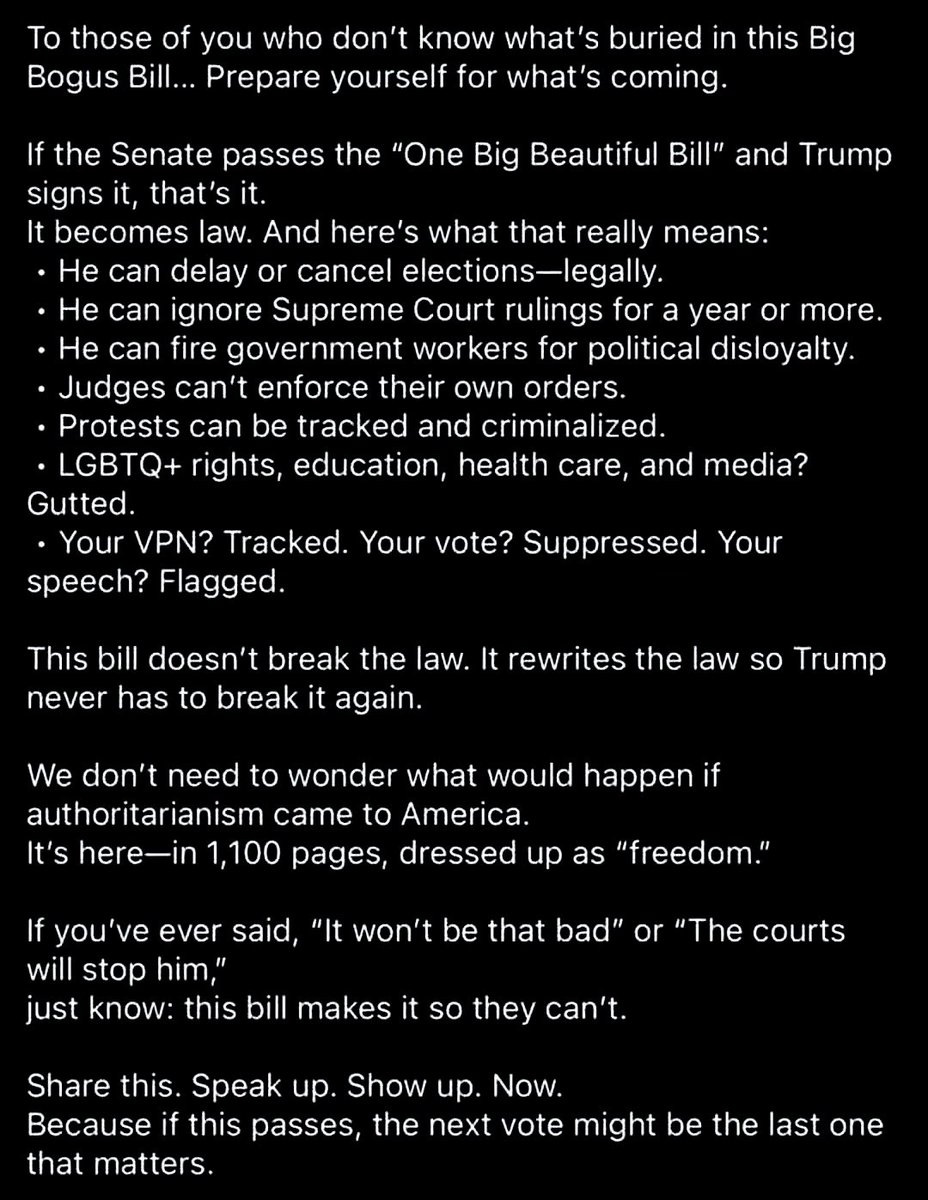

The headlines in the budget reconciliation bill that passed the House by one vote early Thursday morning are well known: massive tax cuts for the rich financed by crippling program cuts in Medicaid and food stamps, raising the federal debt by $3.3 trillion over a decade, and in turn spooking bond markets. But a lot of other mischief is buried in the fine print. Here are ten of the worst:

Crippling Courts. The bill, hiding behind the premise that it is an appropriations measure, prohibits any funds from being used to carry out court orders holding executive branch officials in contempt. This is designed to enable Trump and his officials to continue defying court orders. It is almost certainly unconstitutional—if courts have the nerve to say so.

--

Terminating the Tax Status of Nonprofits. The reconciliation text gives the administration the power to define nonprofits as “terrorist-supporting organizations” and expedite the ending of their tax status. This is ostensibly directed against pro-Palestinian groups, but could be used to suppress the free speech and activism of climate organizations and others.

LetMyPeopleVote

(163,479 posts)flamingdem

(40,424 posts)The media is not mentioning these details. At all. Talk about flooding the zone!!

JoseBalow

(7,533 posts)I haven't heard anything about that. ![]()

justaprogressive

(3,772 posts)Deep State Witch

(11,804 posts)Last month, the House Oversight and Reform Committee advanced its portion of the bill, which would cut federal spending to partially pay for tax cuts for the wealthy and increased immigration enforcement. The measure included provisions requiring employees previously exempted from higher Federal Employees Retirement System contribution rates enacted a decade ago to begin paying 4.4% of their basic pay toward their pensions, eliminating the FERS supplement for most federal workers who retire before Social Security kicks in at 62 and changing the formula that calculates a retiring employee’s annuity payment from an average of their highest three years of salary to one based on their highest five years.

It also would require new federal employees to choose between paying nearly 10% of their basic pay toward their FERS benefits or serving on an at-will basis with no civil service protections.

So, as a Fed who retired early, this will affect me directly for at least a year. I turn 62 in late November 2026. So, if they eliminate the offset, I'm out about $1500 a month.

Add to that, all of those people that took the Fork and retired before their minimum retirement age are going to get screwed.

https://www.govexec.com/pay-benefits/2025/05/house-passes-reconciliation-bill-cuts-federal-employee-retirement-benefits/405523/

flamingdem

(40,424 posts)Can it get through the Senate. We shall see.